Giving to Mercer

Private giving supports Mercer in its mission to equip students to change the world. The generosity of our alumni, faculty, staff, students, and friends grants opportunities and transforms lives. Every gift, no matter the size, makes a difference at Mercer.

Ways To Give

Alumni, parents and friends give to Mercer in a variety of ways including checks, credit cards, electronic fund transfers and gifts of stocks and securities or other assets.

Giving Opportunities

Whether you make a gift to The Mercer Fund, give to an online crowdfunding campaign, participate in the Greek Challenge, create an endowed fund, or give through Phonathon, there are a variety of ways to get involved in supporting Mercer.

Aspire Capital Campaign

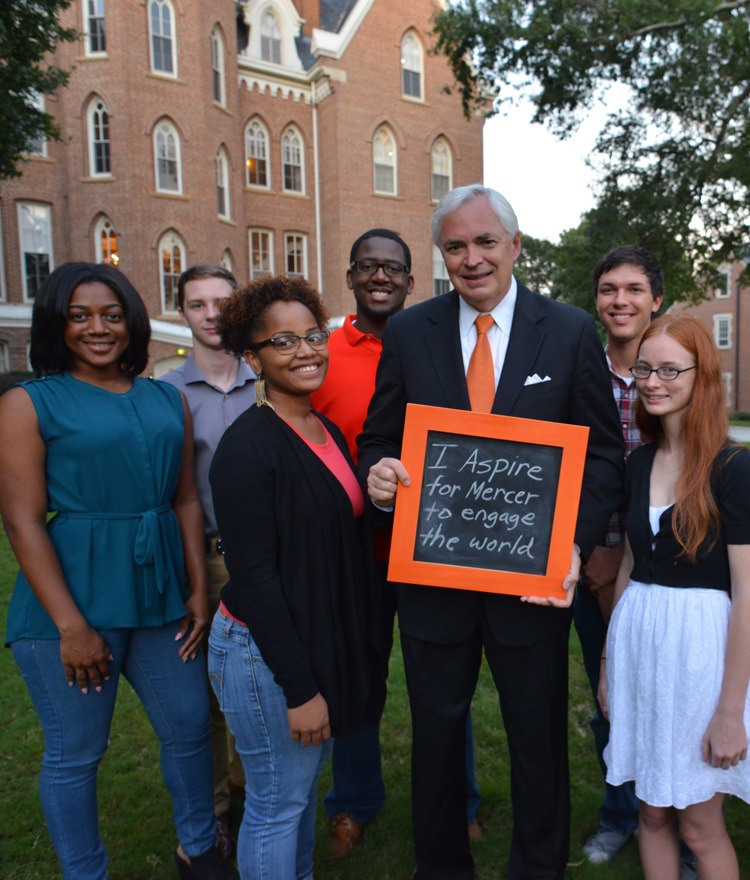

Thanks to the support of thousands of alumni and friends, Aspire, The Campaign for Mercer University, raised more than $500 million. We celebrate all that the Mercer community achieved together, thanks to the visionary leadership, generous philanthropy, and enthusiastic volunteerism. Thank you to everyone who aspired with us!

Our Team

Contact Us

Director of Development, School of Business & The Executive Forum

Associate Vice President for Advancement, Scholarships, Grants, & Libraries

Deputy Athletic Director/Executive Director, Mercer Athletic Foundation

Associate Vice President for University Advancement, School of Law

Senior Associate Vice President for Advancement, University Corporate Engagement & School of Engineering

Director of Development, College of Nursing & College of Professional Advancement

Senior Associate Vice President, Director of Planned Giving & Director of Development, School of Law

Associate Vice President for University Advancement and Executive Director, Alumni Association

Associate Vice President for Advancement, College of Education & School of Music

Office of University Advancement

1501 Mercer University Drive, Macon, Georgia 31207

(478) 301-2715 • (800) 837-2911